Bullion bars have long been a symbol of wealth and a preferred choice for investors looking to safeguard their assets against economic uncertainties. Made from precious bullion bars metals like gold, silver, platinum, and palladium, bullion bars are valued for their purity and weight. In this article, we will focus on gold bullion bars, exploring their history, the benefits of investing in them, the process of buying, and important considerations for investors.

What Are Bullion Bars?

Bullion bars are large, standardized pieces of precious metals that are typically produced with high levels of purity. These bars are cast or minted into uniform sizes and weights, making them an efficient way to store and trade physical precious metals. Unlike coins, which may have collectible or historical value, bullion bars are primarily valued for their metal content.

History of Bullion Bars

The use of bullion bars dates back thousands of years, with early civilizations using metal ingots as a form of currency and wealth storage. The standardization of bullion bars, including the establishment of consistent weights and purity standards, helped facilitate trade and commerce across different regions and cultures. Today, bullion bars continue to be a trusted form of investment, known for their stability and long-term value.

Benefits of Investing in Gold Bullion Bars

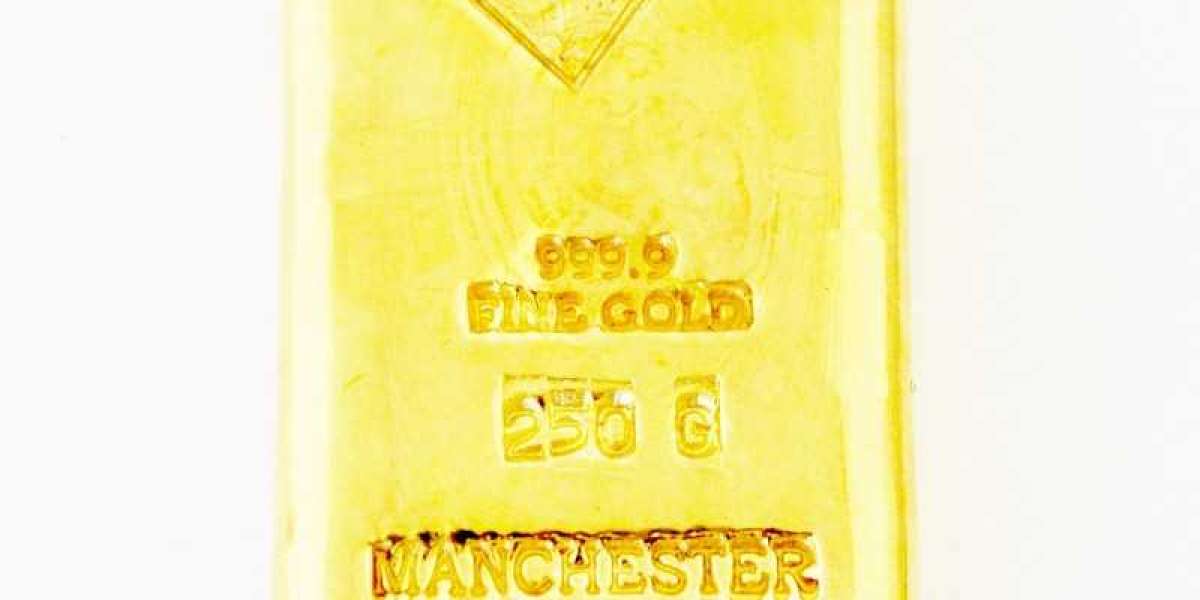

Purity and Standardization: Gold bullion bars are typically made with a high level of purity, often 99.99% (24 karats). This standardization ensures that investors know exactly what they are buying, making it easier to assess and compare value.

Inflation Hedge: Gold has historically been a hedge against inflation. As fiat currencies can lose value over time due to inflation, gold tends to retain its purchasing power, making it a reliable store of wealth.

Liquidity: Gold bullion bars are highly liquid assets. They can be easily bought or sold in global markets, providing investors with flexibility in their investment strategies.

Diversification: Adding gold bullion bars to an investment portfolio can provide diversification. Gold often performs differently from other asset classes like stocks and bonds, helping to reduce overall portfolio risk.

Tangible Asset: Unlike stocks or bonds, gold bullion bars are a tangible asset that investors can physically hold. This tangibility provides a sense of security and control over one’s investment.

How to Buy Gold Bullion Bars

Choosing a Reputable Dealer: The first step in purchasing gold bullion bars is selecting a reputable dealer. Look for dealers with a strong reputation, transparent pricing, and positive customer reviews. Ensure that the dealer provides authenticated bullion bars from recognized mints or refineries.

Verifying Purity and Authenticity: Gold bullion bars should come with markings that indicate their weight, purity, and the hallmark of the mint or refinery. An accompanying assay certificate should confirm these details, providing assurance of the bar’s authenticity.

Understanding Premiums and Costs: The cost of a gold bullion bar includes the spot price of gold plus a premium. This premium covers the costs of refining, manufacturing, and the dealer’s profit margin. Comparing premiums from different dealers can help you get the best deal.

Considering Size and Weight: Gold bullion bars come in various sizes, from small 1g bars to large 1kg bars and beyond. The choice of size depends on your budget, storage considerations, and investment goals. Larger bars typically have lower premiums per gram but may require more secure storage.

Secure Storage Options: Proper storage is crucial for bullion bars protecting your investment. Options include home safes, bank safety deposit boxes, or professional vault services. The level of security and accessibility should guide your choice of storage.

Factors to Consider When Investing in Gold Bullion Bars

Market Conditions: The price of gold can fluctuate due to various factors, including economic data, geopolitical events, and currency movements. Staying informed about these factors can help you make timely and informed investment decisions.

Investment Goals and Horizon: Clearly define your investment goals and time horizon. Are you investing for long-term wealth preservation, short-term gains, or portfolio diversification? Your objectives will influence your purchasing and selling decisions.

Tax Implications: Depending on your location, buying and selling gold bullion bars may have tax implications. It’s wise to consult with a tax professional to understand any potential taxes or reporting requirements.

Storage and Insurance: Consider the cost and logistics of storing and insuring your gold bullion bars. While some investors choose to store their gold at home, others prefer the security of professional vault services.

Conclusion

Gold bullion bars represent a timeless and reliable investment in tangible wealth. Their purity, liquidity, and role as a hedge against inflation make them an attractive option for investors seeking stability and security. By choosing reputable dealers, understanding the costs involved, and ensuring proper storage, you can make informed decisions and enjoy the benefits of owning gold bullion bars. Whether you are looking to diversify your portfolio or protect your wealth, gold bullion bars offer a solid foundation for any investment strategy.